Corporate Transparency Act: New Beneficial Ownership Reporting Requirements Starting January 1, 2024

Key Points

- The Corporate Transparency Act (the “CTA”), implemented primarily through a rule published by FinCEN on September 30, 2022, the Beneficial Ownership Information Reporting Rule (“BOIR Rule”), becomes effective on January 1, 2024, triggering beneficial ownership reporting requirements for millions of businesses.

- The definition of Reporting Company laid out in the BOIR Rule is quite broad and will encompass most U.S. companies and many non-U.S. entities.

- Beneficial Owners are individuals who, directly or indirectly, either exercise substantial control over a Reporting Company or own or control at least 25% of the ownership interests of a Reporting Company.

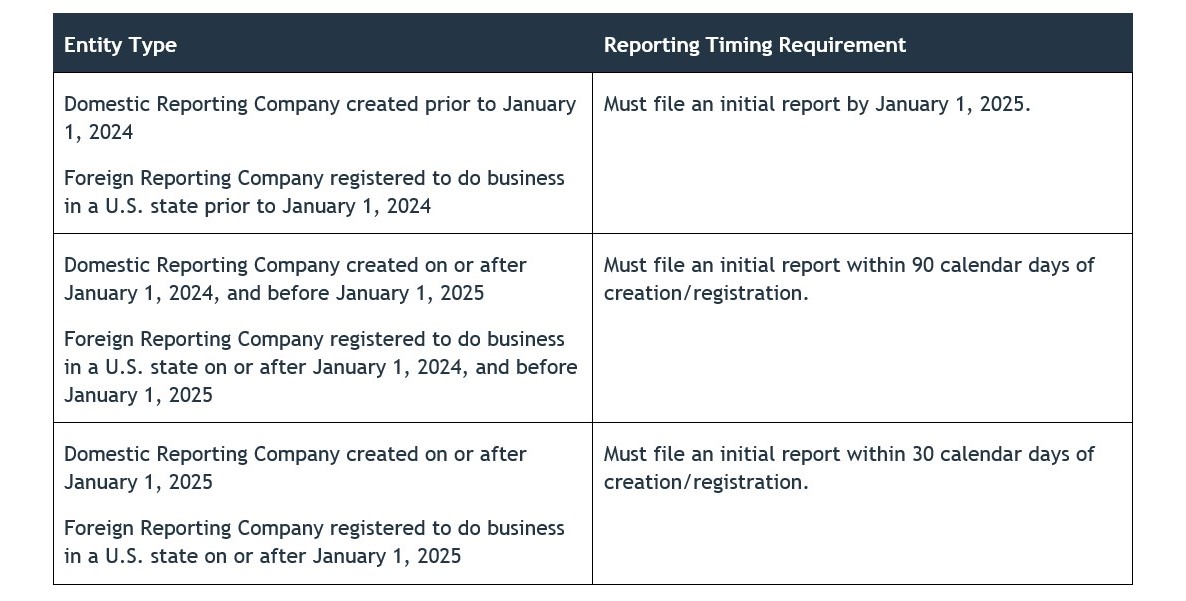

- Domestic Reporting Companies in existence prior to January 1, 2024, and foreign Reporting Companies registered to do business in a United States state prior to January 1, 2024, have until January 1, 2025 to submit initial reports to FinCEN. Reporting Companies that are established on or after January 1, 2024, but before January 1, 2025 (i.e., during calendar year 2024) will have 90 calendar days to submit initial reports. Reporting Companies established on or after January 1, 2025, will have 30 calendar days to submit initial reports.

- There are 23 exemptions to the definition of Reporting Company that will relieve a substantial number of companies from reporting requirements. The exemptions are generally designed to exempt entities that already report ownership information to the U.S. government in some way.

- While the CTA will impose reporting requirements on many different types of businesses, investment funds and managers, among others, should pay close attention to provisions of the CTA and the BOIR Rule. Many private fund vehicles as well as fund sponsor or management platforms are likely to include Reporting Companies. We will be releasing more a funds-focused alert on the CTA beyond this alert.

- Companies should review the CTA and the BOIR Rule carefully to determine whether reporting requirements apply.

Background

Enacted into law on January 1, 2021, the CTA becomes effective on January 1, 2024 (see Akin’s prior client alert here).1 The general objective of the CTA is to prevent bad actors from using legal entities, particularly shell companies, in the United States to commit crimes. Over nearly three years since the CTA was passed, FinCEN has published several rules implementing the provisions of the CTA. FinCEN published the primary rule, which describes (1) what entities are required to report (2) when reporting requirements begin and (3) what reporting entails, on September 30, 2022.2 FinCEN published a final rule extending the reporting timeline for Reporting Companies established on or after January 1, 2024, but prior to January 1, 2025 on November 29, 2023.3 FinCEN has also published a proposed rule that is not yet finalized proscribing access to and safeguards of the database that will house reported beneficial ownership information.4

The key questions entities, both U.S. and non-U.S., must ask themselves in anticipation of the effective date of the CTA are the following:

-

- Do I fall under the broad definition of a Reporting Company?

- Do I meet any of the 23 exemptions to the definition of a Reporting Company?

- If I am a Reporting Company and do not meet an exemption:

- What information must I report to FinCEN?

- When do I have to submit a report?

This alert addresses each of these threshold questions below. See FinCEN’s website for additional materials, including FAQs, on reporting requirements.

1. Do I fall under the broad definition of a Reporting Company?

A threshold consideration under the CTA is whether an entity meets the definition of a Reporting Company. If the answer is no, the CTA does not apply, and the entity does not have to report. The BOIR Rule divides Reporting Companies into two groups: domestic Reporting Companies and foreign Reporting Companies. Domestic Reporting Company is defined as a corporation, limited liability company, or other entities created by the filing of a document with a secretary of state or similar office under the law of a U.S. state or Indian tribe. Foreign Reporting Company is defined as a corporation, limited liability company, or other entity formed under the law of a foreign country and registered to do business in any U.S. state by the filing of a document with a secretary of state or similar office under the law of a U.S. state or Indian tribe.

Although most domestic entities will be caught by this definition, certain domestic legal entities or arrangements are not created by the filing of a document with a secretary of state or similar office and consequently are not subject to CTA reporting obligations. For example, certain types of trusts would not be Reporting Companies because they are not created by the filing of a document with a secretary of state or similar office.

Many, if not most, foreign entities will not be considered Reporting Companies. Only foreign entities that are registered to do business in a U.S. state (e.g., qualified to do business in New York) will be caught by this definition.

2. Do I meet any of the 23 exemptions to the definition of Reporting Company?

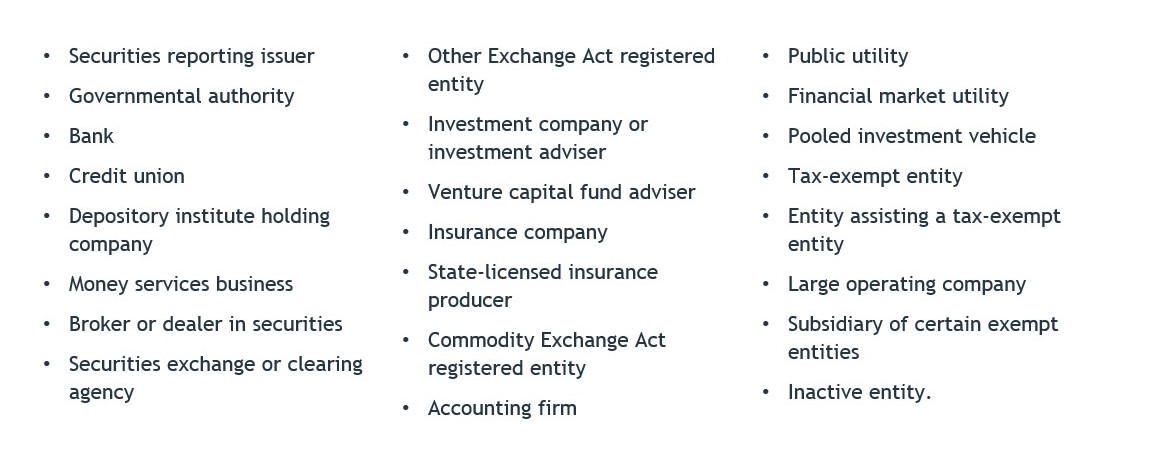

If the answer to Question 1 above is yes, then consideration should be given to the 23 exemptions to CTA reporting obligations laid out in the BOIR Rule to determine if any apply. The stated purpose of these exemptions is to exempt from the CTA reporting requirements entities that are already subject to separate U.S. regulatory obligations to report ownership information to the U.S. government. The 23 exemptions are as follows:

Each exemption has specific requirements that an entity must satisfy to qualify for the exemption. For example, to take advantage of the “large operating company” exemption, an entity must (1) employ 20 full time employees in the United States; (2) have an operating presence at a physical office in the United States and filed a federal income tax or information return in the United States demonstrating more than $5,000,000 in gross receipts or sales.

3. What information do I have to report?

Initial reports to FinCEN must include certain information with respect to: (1) the Reporting Company itself; (2) the Reporting Company’s Beneficial Owners; and (3) in the event that the Reporting Company was created or registered to do business in a U.S. state after January 1, 2024, the Reporting Company’s Company Applicant. A Company Applicant is the individual who, in the case of a domestic Reporting Company, directly files the document that creates the company, and, in the case of a foreign Reporting Company, directly files the document that registers the company to do business in a U.S. state. If more the one individual is involved in the filing, the individual who is primarily responsible for directing or controlling the filing is also a Company Applicant.

These reports must also include certain information about the Reporting Company itself, such as the company’s legal name, current address, state of formation, and IRS Taxpayer Identification Number. If the Reporting was created or, in the case of a foreign Reporting Company, registered to do business in a U.S. state, on or after January 1, 2024, the initial report must include similar identifying information on the company’s Company Applicant.

The initial reports must also identify each of a Reporting Company’s Beneficial Owners. A Beneficial Owner is defined as any individual who, directly or indirectly, either exercises substantial control over a Reporting Company or owns or controls at least 25% of the ownership interests of a Reporting Company.[5] Initial reports must include the individual’s legal name, date of birth, current address, and a photograph of an identification document (e.g., passport or driver’s license).

Once an initial report is filed, Reporting Companies do not have annual filing requirements. However, the CTA requires the filing of updated or corrected reports if necessary. Specifically, Reporting Companies are required to file an updated report in the event that there is any change with respect to required information previously submitted to FinCEN concerning the Reporting Company or its Beneficial Owners. However, changes in information concerning a Reporting Company’s Company Applicant do not need to be updated. A Reporting Company also must file a corrected report in the event that information submitted to FinCEN was inaccurate when filed and remains inaccurate. Corrected reports must be submitted within 30 calendar days of the date on which the Reporting Company became aware of the inaccuracy or had reason to be aware of the inaccuracy.

4. When do I have to report?

The below table describes the applicable reporting deadlines for different Reporting Companies, depending on when the Reporting Company is/was established and assuming no exemption applies.

Companies should review the CTA and the BOIR Rule carefully to determine whether reporting requirements apply. Many open questions remain concerning implementation of the BOIR Rule and FinCEN continues to issue guidance in the form of Frequently Asked Questions. We continue to monitor developments in this space and would be happy to discuss any questions in the meantime.

1 https://www.fincen.gov/sites/default/files/shared/Corporate_Transparency_Act.pdf

2 https://www.federalregister.gov/documents/2022/09/30/2022-21020/beneficial-ownership-information-reporting-requirements

3 https://www.federalregister.gov/documents/2023/11/30/2023-26399/beneficial-ownership-information-reporting-deadline-extension-for-reporting-companies-created-or

4 Federal Register :: Beneficial Ownership Information Access and Safeguards, and Use of FinCEN Identifiers for Entities

5 The BOIR Rule defines “substantial control,” “ownership interest,” as well as what it means to own or control an ownership interest.