EU Regulatory Developments on Credit Markets

What’s New?

A new European Union (EU) Directive on Credit Servicers and Credit Purchasers (the Directive)1 requires investors who acquire, manage, or sell non-performing loans (NPLs), issued by EU-authorised credit institutions (EU Banks) in the secondary market, to engage an appropriately authorised EU entity, including an EU credit servicer or become appropriately authorised as a credit servicer by an EU financial regulatory authority.

Overview

The Directive provides EU-wide rules governing transactions in and servicing of NPLs issued by or novated to EU Banks. While local credit servicing regimes exist (and will continue to apply during a transitional period), the Directive introduces an EU-wide regime which sets out, amongst other things, the key requirements applicable to credit purchasers buying or selling NPLs, the authorisation requirements and process for credit servicers, high level standards applicable when dealing with underlying borrowers, certain mandatory conditions when outsourcing servicing of NPLs to a third party and a minimum level of information to be provided to a prospective credit purchaser of NPLs.

Who Does It Apply to?

- ‘Credit purchasers’, broadly, natural or legal persons (other than EU Banks) which buy NPLs (or rights under NPLs) issued by EU Banks for investment purposes.2 Credit purchasers may (and often do) outsource the administration of the NPL to ‘credit servicers’.

- ‘Credit servicers’, broadly, legal persons that manage the administration of NPLs on behalf credit purchasers,3 and which carry on one or more ‘credit servicing activities’: collecting or recovering payments; renegotiating loan terms and conditions with the borrower; administering complaints relating to a creditor’s rights; or general communication with borrowers, including, informing borrowers of any changes relating to the NPL’s interest rate, charges or payments.4

Does It Apply to Non-EU Investors?

Yes. In addition to the requirement to appoint an appropriately authorised credit servicer (where applicable), non-EU credit purchasers are required to appoint an EU representative that will act as the point of contact for EU regulators, and will be responsible for the compliance of the non-EU credit purchaser under the Directive. The Directive applies to non-EU investors regardless of whether they have registered their funds for marketing in the EU.

When will the Directive Take Effect?

The Directive requires each EU Member State to implement its provisions into domestic law by 29 December 2023.

Transfers of relevant NPLs, which do not complete before 30 December 2023,5 will be in scope of the Directive. There are transitional measures for EU credit servicers already carrying out ‘credit servicing activities’ on 30 December 2023 that can continue with these credit servicing activities in their home Member State without authorisation until 29 June 2024.6

Are There Any Exclusions or Exemptions?

The Directive does not apply to:

- Credit servicing activities carried out by EU Banks, EU Alternative Investment Fund Managers (AIFMs) authorised or registered in accordance with the AIFMD7 (EU AIFMs)8 and certain other categories of EU persons.9

- Credit servicers of NPLs originating from non-EU banks unless the NPL is then novated or assigned to an EU Bank.10

No exemption appears to be available for non-EU AIFMs dealing in NPLs issued by (or novated or assigned to) an EU Bank.

Key Requirements

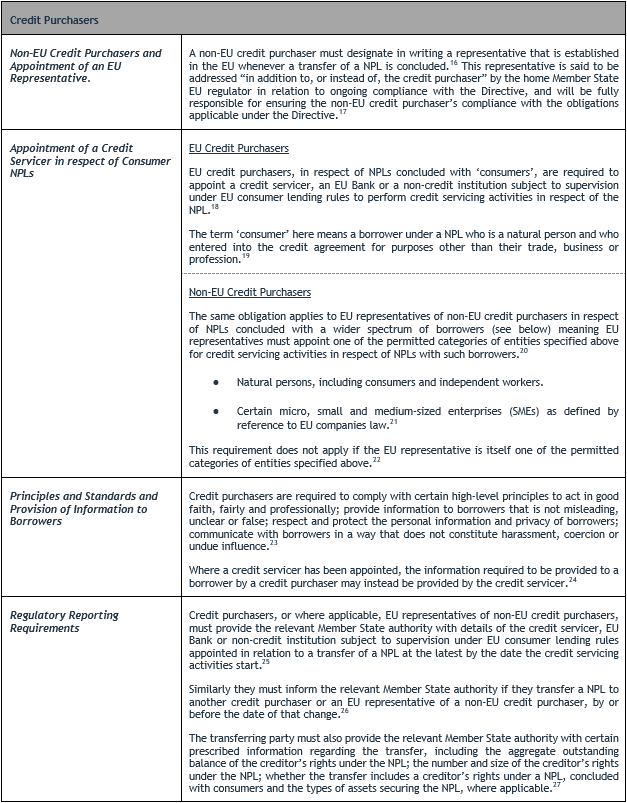

- Credit purchasers must appoint an appropriately authorised EU entity, including an authorised credit servicer, an EU Bank or a non-credit institution subject to supervision under EU consumer lending rules to administer consumer NPLs. Consumer NPLs encompass a broader range of borrowers (and include SMEs) where non-EU credit purchasers are concerned.11 EU Member States may extend the scope of this requirement to other credit agreements.

- Non-EU credit purchasers must appoint an EU representative. The EU representative is required to ensure the credit purchaser’s compliance with obligations applicable to a credit purchaser under the Directive.

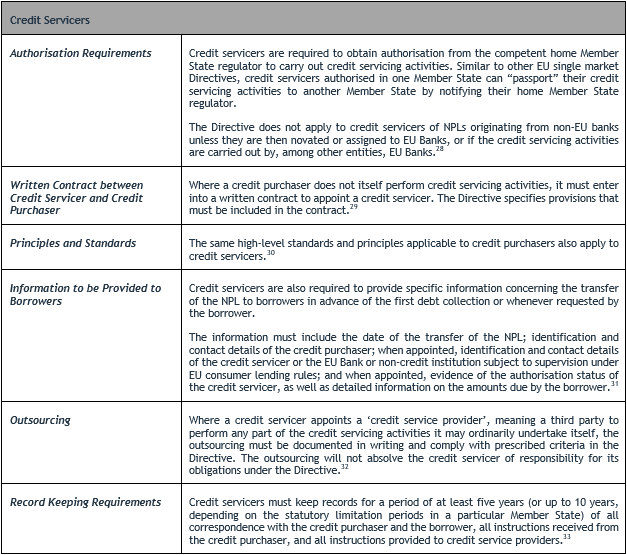

- Credit servicers must enter into a written contract with the credit purchaser. The contract must include prescribed terms reflective of the relevant national law and the Directive.

- Both credit servicers and credit purchasers must comply with overarching standards and principles when engaging with borrowers. For example, to act in good faith, fairly and professionally, and to provide information to borrowers that is not misleading, unclear or false.12

- Credit purchasers must provide information regarding the transfer of NPLs to borrowers, unless the appointed credit servicer, EU Bank or EU supervised non-credit institution provides such information.13

- Credit purchasers must notify their home Member State EU regulator regarding any NPL transfers and the details of the appointed credit servicer, EU Bank or EU supervised non-credit institution.14

For further details about the requirements above, please see below the Appendix to this note.

Penalties

The specific sanctions and penalties for a breach of the Directive will be governed by local law implementing the Directive applicable to the credit servicer or credit purchaser. However, the Directive requires that Member States include in local law certain base line sanctions, including administrative financial penalties and remedial measures in a number of specific situations, including for a breach of certain of the obligations above.15

What Are the Key Next Steps?

Investors should assess whether they are required to take steps to appoint credit servicers. Non-EU investors should take steps to identify an EU representative. These functions may be performed by a single service provider.

The investors may also review their existing servicing arrangements to ensure those comply with the minimum requirements set out in the Directive.

Contribution from Suley Siddiqui, Phil Davies and Mike Gorski is greatly appreciated.

Appendix

Key Features of the Regime for Credit Purchasers and Credit Servicers.

1 Directive (EU) 2021/2167 (EUR-Lex).

2 Article 3(6) of the Directive.

3 Article 3(8) of the Directive.

4 Article 3(9) of the Directive.

5 Article 2(5)(d) of the Directive.

6 Article 32(2) of the Directive.

7 “AIFMD” means Directive 2011/61/EU (as amended).

8 Article 2(5)(a)(i) and (ii) of the Directive.

9 The Directive does not apply to the credit servicing activities carried out by the following other EU persons: management companies, or investment companies that have not designated a management company, authorised in accordance with Directive 2009/65/EC (Article 2(5)(a)(ii) of the Directive); non-credit institutions subject to supervision by an EU regulator, in accordance with Article 20 of Directive 2008/48/EC or Article 35 of Directive 2014/17/EU, when performing activities in that EU Member State in which it is supervised, namely entities engaged in consumer lending activities (Article 2(5)(a)(iii) of the Directive). Member States are permitted to exempt from the application of the Directive, the credit servicing activities of certain professions: public notaries, bailiffs or lawyers when implementing the Directive into local law (Article 2(6) of the Directive).

10 Article 2(5)(b) of the Directive.

11 Article 17(1) (a) and (b) of the Directive.

12 For further details, please see the Appendix to this note.

13 Article 10(2) of the Directive.

14 Article 18(1) and Article 20(1) of the Directive.

15 Article 23 (1) and (2) of the Directive.

16 Article 19(1) of the Directive.

17 Article 19(2) of the Directive.

18 Article 17(1)(a) of the Directive.

19 Article 3(12) of the Directive.

20 Article 17(1)(b) of the Directive.

21 ‘SMEs’ as defined in Article 2 of the Annex to Commission Recommendation 2003/361/EC (EUR-Lex).

22 Article 17(b) of the Directive.

23 Article 10(1) of the Directive.

24 Article 10 of the Directive.

25 Article 18(1) of the Directive.

26 Article 18(2) of the Directive.

27 Article 20 of the Directive.

28 Article 2(5)(a)(i) and (ii) of the Directive.

29 Article 11 of the Directive.

30 Article 10(1) of the Directive.

31 Article 10(2) of the Directive.

32 Article 12 of the Directive.

33 Article 11(4) of the Directive.