FTC Updates HSR Filing Fees and Revises Thresholds for 2024; Minimum Size for Reportable Transactions Increases to $119.5 Million

Key Points

- The HSR Act requires parties that meet certain transaction size and other tests to file premerger notification forms for mergers and other transactions with both the Federal Trade Commission (FTC) and Department of Justice Antitrust Division.

- For 2024, the jurisdictional thresholds in the HSR Act will increase by slightly less than 10%, which means that the minimum size-of-transaction threshold for reporting proposed mergers and acquisitions will increase from $111.4 million to $119.5 million.

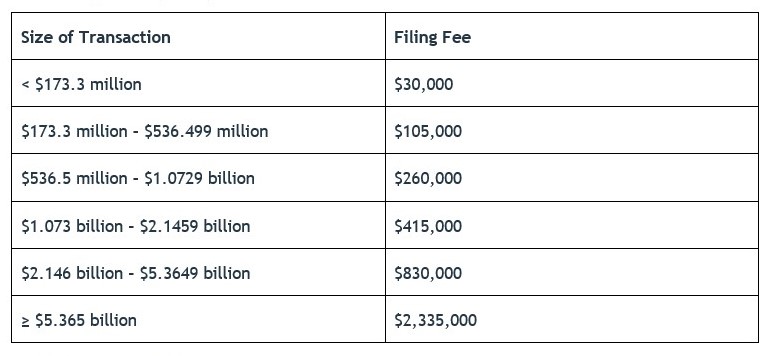

- For 2024, HSR filing fees for many transactions will increase. Filing fees will range from $30,000 to $2.335 million. In addition to the revised thresholds and filing fees, the 2024 thresholds that trigger prohibitions on certain interlocking memberships on corporate boards of directors will also increase.

- The changes to the jurisdictional thresholds and filing fees will go into effect 30 days after publication in the Federal Register, which we expect to occur in the coming days.

The Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act) requires all parties to transactions that meet certain transaction size and other tests to file premerger notification forms for mergers and other transactions with both the FTC and the Department of Justice Antitrust Division. The HSR Act also requires those parties to observe a mandatory waiting period prior to closing while the agencies consider the competitive effects (if any) of the transaction. The new thresholds and filing fees will apply to transactions consummated on or after the effective date, which is 30 days after publication in the Federal Register.

The Size-of-Transaction Threshold

The size-of-transaction threshold is reviewed every year, and for 2024 the minimum transaction size has increased from $111.4 million to $119.5 million. Under the revised thresholds, HSR filings will be required (unless otherwise exempted) for transactions that result in the acquiring person holding more than $119.5 million of the acquired person’s voting securities, non-corporate interests or assets.

The Size-of-Person Thresholds

The size-of-person thresholds have increased by a similar percentage. While the HSR Act size-of-person rules are complex, under the new thresholds an HSR Act filing is generally not required for transactions valued at more than $119.5 million but less than $478.0 million, unless one party to the transaction has $239.0 million in annual net sales or total assets and the other party has $23.9 million in annual net sales or total assets. The potential exemption afforded by the size-of-person test is inapplicable to transactions valued at more than $478.0 million; as a result, transactions valued at more than $478.0 million will be reportable under the HSR Act regardless of the size of the parties to the transaction (unless otherwise exempted).

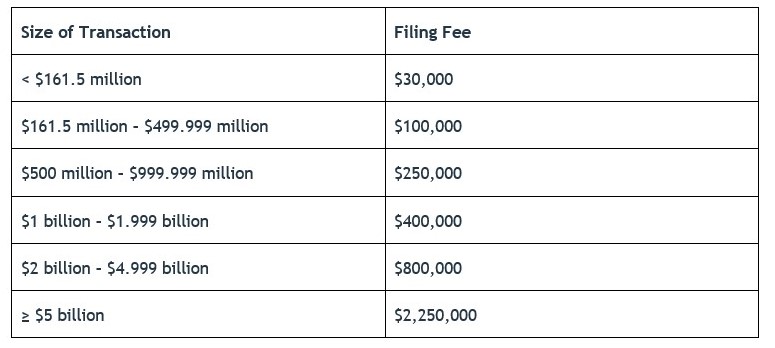

HSR Filing Fee

The FTC revises the HSR filing fee schedule annually based on changes in the gross national product and in the consumer price index. Below are tables comparing the new and old fee schedules.

HSR Filing Fees (2024)

HSR Filing Fees (2023)

There are many exemptions and exceptions to the HSR filing requirement, and parties contemplating merger and acquisition activity, as well as investments meeting the HSR transaction size threshold, are strongly encouraged to consult antitrust counsel to determine whether HSR notification is required. The agencies have also proposed to overhaul the HSR form, which, if implemented, would substantially expand the scope of information required from filers, and increase the cost and time required to prepare HSR filings (see prior client alert for more information on the proposed changes). Persons who fail to file and do not observe the waiting period when required to do so face civil penalties of up to $51,744 per day.

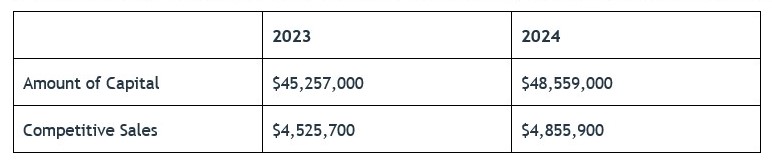

Increased Thresholds for Interlocking Directorates

Section 8 of the Clayton Act prohibits a person from serving as a director or officer of two competing corporations. However, interlocks are exempt from Section 8 where either: (1) each corporation has capital, surplus and undivided profits aggregating less than $10 million, as adjusted (Amount of Capital); (2) the competitive sales of either corporation are less than $1 million, as adjusted (Competitive Sales); (3) the competitive sales of either corporation are less than 2% of that corporation’s total sales; or (4) the competitive sales of each corporation are less than 4% of each corporation’s total sales.

The first two exemptions are adjusted annually based on changes in gross national product, which for 2024 reflects an increase of slightly less than 10%. Below is a table comparing the old and new adjusted thresholds.

Notably, the thresholds for Section 8 of the Clayton Act become effective immediately upon their publication in the Federal Register (not 30 days afterwards like the HSR changes).