The FCA’s final policy statement and the push for increasing transparency for investors on diversity and inclusion (D&I) matters is part of a wider international push for D&I on company boards. In the United States, new NASDAQ listing rules on board diversity disclosures and targets, which we wrote about here, are coming into effect from August 8, 2022—requiring in-scope companies to similarly disclose board-level diversity statistics1 on an annual basis and have a minimum of two diverse board members.2 As with the incoming FCA rules, the NASDAQ disclosures are to be provided according to standardized formats on a comply-or-explain basis, with the hope that they enable investors to better understand company approaches to D&I.3

Which Issuers Are Subject to the New Requirements?

United Kingdom and overseas issuers with equity shares (or certificates representing equity shares) admitted to the premium or standard segment of the FCA’s Official List are in-scope for the purposes of the new requirements. The requirements also apply to closed-ended investment funds and sovereign-controlled companies, but do not apply to open-ended investment companies, “shell companies” or issuers of listed debt and debt-like securities, securitized derivatives or miscellaneous securities.

New Diversity Targets

Issuers that are within the scope of the new rules must, on a ‘comply or explain’ basis, seek to meet the new diversity targets. Issuers must include a statement in their annual financial report stating whether they have satisfied the following targets (the “Targets”):

- The board consists of at least 40 percent women.

- At least one of the senior board positions (Chair, Chief Executive Officer (CEO), Senior Independent Director (SID) or Chief Financial Officer (CFO)) is held by a woman.

- At least one member of the board is from a minority ethnic background.4

If the issuer is unable to comply with the Targets, then it must explain the reasons for noncompliance in its annual report. The FCA’s guidance clarifies that issuers within the scope of the disclosure requirements should also include the following contextual information:

- A brief summary of any key policies, procedures and processes, and any wider context that the issuer considers to contribute to improving the diversity of its board and executive management.

- Any mitigating factors or circumstances which make achieving diversity on its board more challenging (for example, the size of the board or the country where its main operations are located).

- Any risks it foresees in being able to meet or continue to meet the board diversity targets in the next accounting period, or any plans to improve the diversity of its board.

If the reporting reference date does not align with the accounting reference date, the reporting issuer should explain the reason for divergence. Any changes that have affected the issuer’s ability to meet one or more of the Targets between the reference date and the date on which the annual financial report is approved must also be noted.

Data Disclosure

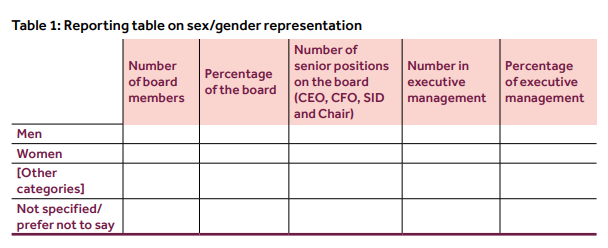

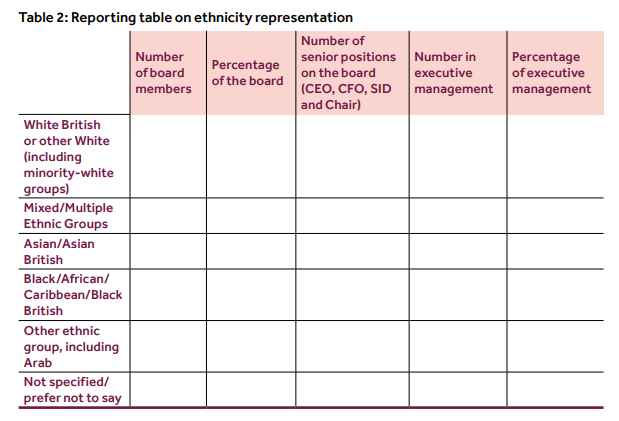

Accompanying the forward-looking diversity Targets is a new set of disclosure requirements regarding the present diversity of the boards. Alongside the annual narrative comply or explain disclosures, the FCA requires issuers to publish quantitative data on the sex or gender identity and ethnic diversity of their boards, senior board positions (Chair, CEO, SID and CFO) and executive management in the standardized table formats set out below:

The parameters for the data collected for disclosure purposes are not prescribed but should be objectively justifiable and consistent. Where the collected data is self-reported by natural persons, a description of the questions asked to obtain such data should be provided. An explanation of the data-collection approach and data sources used must be presented together with the disclosures.5

The FCA permits adjustments and exemptions to the above disclosures, provided they are explained in the statement, with respect to issuers who have members of their board or executive management situated overseas, and who are subject to local laws preventing the collection or publication of the data required for the quantitative disclosure. Similarly, closed-ended investment funds and sovereign-controlled companies are exempt from the disclosure requirements where the disclosures are inapplicable.

Looking Ahead

The Targets and quantitative disclosures are but a “first step” in setting out a new regulatory framework on D&I. Further to the FCA’s joint paper with the Prudential Regulation Authority (PRA) and Bank of England, a consultation paper is expected to be published later this year, setting out the broad proposals that will build upon and reinforce that existing D&I-related legislation.

We encourage issuers to stay abreast of future developments in this area and invite our friends and clients to get in touch with Akin Gump to further discuss next steps.

1 NASDAQ Rule 5606.

2 NASDAQ Rule 5605(f).

3 We note here that NASDAQ’s Diversity Rule is currently subject to a legal challenge currently pending before the U.S. Circuit Court of Appeals for the 5th Circuit. The case is styled Alliance for Fair Board Recruitment v. SEC, No. 21-60626.

4 Defined by reference to categories recommended by the Office for National Statistics (ONS) and excluding those listed, by the ONS, as coming from a white ethnic background.

5 LR 9.8.6I G and LR 14.3.36G.