Moore Tax Case at Supreme Court—What the Coming Decision Could Mean for Corporations (Including Altaba)

By: Stuart E. Leblang, James E. Tysse, Michael J. Kliegman and Amy S. Elliott

On December 5, 2023, the U.S. Supreme Court heard oral arguments in a case that many in the tax world were shocked the court agreed to take up—Moore, Charles G., et ux. v. United States.1 The decision will be issued in the coming months (by the end of June2). The court will decide whether it is constitutional to tax income that the Internal Revenue Service (IRS) deems a shareholder to have earned even though the shareholder did not actually receive the income.3

The case has received a lot of attention, in part because it could have big-dollar consequences to both the government and certain taxpayers. In its most extreme scenario, the Tax Foundation estimated that a loss at the Supreme Court could cost the government nearly $5.7 trillion in tax revenue over 10 years.4 In that case, certain companies and individuals could get tax refunds and certain corporate tax provisions might be implicated on a going-forward basis, including in particular the new 15 percent corporate alternative minimum tax (CAMT), the tax on global intangible low-taxed income (GILTI) and the tax on Subpart F income, among many others.

The question before the Supreme Court is fairly straightforward. Does income need to be received in order for taxing it to be constitutional under the Sixteenth Amendment?5 Or is so-called realization not a constitutional prerequisite? The tax at the heart of the dispute is the Section 965 one-time mandatory repatriation tax (MRT). The MRT—which we’ve previously referred to as the toll tax, the transition tax or the deemed repatriation tax—was imposed by the 2017 Tax Cuts and Jobs Act (TCJA) as part of a transition to a more territorial system of taxation and was payable over an eight-year period.

Recall that, pre-TCJA, the U.S. corporate tax rate was 35 percent, and the tax was imposed on all of a U.S. multinational’s worldwide income, unless it took the position that it was never going to bring its income earned offshore back to the United States (so-called deferral, creating a lock-out effect). TCJA permanently reduced the corporate rate to 21 percent and created a new dividend exemption that aimed to end the lock-out effect, paying for these changes in part by the one-time MRT. But the MRT was generally effected by way of a deemed income inclusion (of the pro rata share of accumulated post-1986 deferred earnings, now taxed in 2017 or 2018) to certain corporate shareholders (at reduced rates, because the income inclusion was paired with a corresponding deduction, resulting in an effective tax rate of as little as 8 percent).

The government argued that the Sixteenth Amendment doesn’t require strict realization to the taxpayer (it thinks the MRT’s constitutionality doesn’t depend on whether the taxed corporate shareholders received, in-hand, a distribution of income). The Moores’ position is that Supreme Court precedent Eisner v. Macomber6 supports the notion that income has to be realized in order for it to be subject to tax under the Sixteenth Amendment (citing the “from whatever source derived” language in the Sixteenth Amendment—where the petitioners read “derived” to mean that the income must essentially have been converted into money). The petitioners warned that, “without realization, there is no limiting principle” on Congress’s power to tax.

Counsel for the Moores suggested the Court could rule in their favor without threatening the rest of the Tax Code by inventing a new doctrine of “constructive realization.” But the government insisted that taxpayers would find workarounds and that such a path would be dangerous.

Teasing the Real-World Impact to Corporations

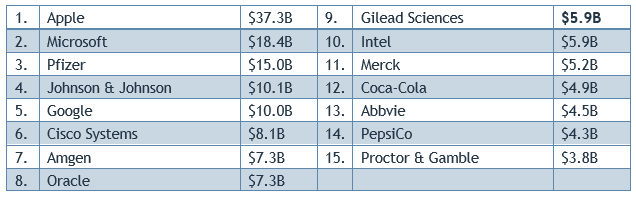

In this report, we will provide a bit of additional background on Moore (for a deeper dive into the arguments, see the Appendix) and address the impact the case could have on public companies (including, in particular, Altaba Inc., which trades over-the-counter as 021ESC017 (Altaba)) and their shareholders. Over 3,200 corporations were subject to the MRT (for a list of the top public companies—largely those in the pharmaceutical and tech sectors—see page 9).7 The Joint Committee on Taxation estimated that the MRT would bring in some $339 billion over

10 years.8

Before we get too deep into the weeds, though, there is fairly widespread agreement among those who have been following the case (and, in particular, the justices’ inclinations as evidenced by the oral argument) that many if not most of the justices seem interested in ruling narrowly in favor of the government. If the MRT is upheld, then the parade of horribles described below would be avoided (although there is a chance that the justices could rule in a way that would complicate future imposition of mark-to-market or wealth taxes, which—depending on your point of view—could pose problems for addressing income inequality and shoring up the Social Security Trust Fund, for example). To put it plainly, if the MRT is upheld, the real-world impact on corporations should most likely be minimal to nonexistent.

But because there is so much at stake in this case (and because it is safer to assume that nothing is ever as sure as it seems from oral arguments), we wanted to consider some of the possible repercussions if the Supreme Court were to strike down the MRT. Depending on the breadth of the decision, the impacts of this case could extend well beyond the MRT. It could also mean, among other things, that repatriated earnings would no longer qualify for the Section 245A dividends received deduction (a TCJA benefit to corporations of some $223.6 billion over 10 years, according to the Joint Committee on Taxation).9 Alternately, some argue that corporations could get a refund of the MRT while keeping the other (related) benefits from TCJA, including Section 245A.

In Altaba’s case, it isn’t a potential refund of the MRT or a potential loss of Section 254A that has got shareholders’ attention. It is another TCJA-related provision—the basis step-up associated with the deemed income inclusions that essentially effectuate both the MRT and GILTI. As we have written about extensively, Altaba had two large stakes in foreign companies that caused it to be subject to the MRT and GILTI (one in Alibaba Group Holding Ltd. (NYSE: BABA) and another in Yahoo! Japan Corp. (TOKYO: 4689)). It ended up selling those stakes (mostly in 2018 and 2019) after it paid some $650 million in MRT,10 but Altaba saved more in taxes from the MRT-related basis step-up than it paid in MRT.

According to its own disclosures, Altaba recorded a net income tax benefit of $1.5 billion “for a reduction of the Fund’s deferred tax liability on unrealized gains in our investments for the tax basis step-up resulting from the one-time deemed repatriation”—this was just part of Altaba’s $11 billion net income tax benefit related to TCJA overall.11 Might Altaba—which has extended its statute of limitations on assessment while the IRS examines its 2018 and 2019 returns—owe some $1.2 billion12 in taxes were the Supreme Court to broadly overturn the MRT in Moore?

Background on Moore

The individuals in this case are a married couple—Kathleen F. and Charles G. Moore—who, at the urging of a friend, invested $40,000 in 2006 for an 11-percent interest in a private, start-up company based in India. The company, KisanKraft, Ltd., which has since grown to have nearly 400 employees, manufactures and sells small-scale agricultural equipment to Indian farmers with limited land (such as machines that assist with planting, harvesting, etc.). The Moores’ investment triggered an MRT of around $15,000 in 2017. The tax was imposed on the post-1986, previously untaxed earnings of certain foreign corporations (and levied on certain shareholders) whether or not the earnings were actually brought back to the United States.

While it was largely the case that U.S. multinationals had to pay the tax with respect to the earnings they had been accumulating (and not paying U.S. tax on) in their controlled foreign corporations (CFCs), the tax also hit U.S. corporations, partnerships and individuals that owned at least 10 percent of certain foreign entities. In the case of the Moores, the MRT essentially looked at the retained earnings in KisanKraft (since 1986) and deemed the couple’s portion (based on their 11-percent interest) of those earnings to be dividended back to the Moores, subjecting them to this one-time tax. At the time of the MRT, the Moores hadn’t actually received any dividends from KisanKraft, and the couple took issue with having to pay some $15,000 of tax on phantom income.13 The Moores paid the tax and then (with the help of the Competitive Enterprise Institute) sued for a refund. They lost at the district and circuit court levels but then petitioned the Supreme Court for review.

If the Supreme Court rules that it is constitutional to allow a tax on unrealized gains, then lawmakers might feel they have freer reign to impose new federal taxes on wealth.14 On the other end of the spectrum, if the Supreme Court rules that unapportioned taxes cannot be levied on unrealized gains, then it could “dismantle or unsettle wide swaths of the tax code, including fundamentals of the tax system that have been on the books for decades and were built on a bipartisan basis.”15

Apart from the Section 965 MRT, the “wide swaths of the tax code” in potential peril (or at least potentially implicated) include (this list is not exhaustive): the Subpart F rules in Sections 951 through 960 (including those that provide for the TCJA-related basis step-up benefit to Altaba), the Section 245A deduction to effectuate participation exemption, the GILTI rules in Section 951A, the CAMT rules including those in Section 56A, the branch profits tax rules in Section 884, the inclusion of original issue discount income rules in Section 1272, the mark-to-market rules for Section 1256 contracts, the mark-to-market rules for expatriates in Section 877A, the mark-to-market rules for dealers in securities in Section 475, the special rules for modified guaranteed contracts in Section 817A, the rules concerning passive foreign investment companies in Section 1297, the check-the-box regulations, fundamental rules involving the taxation a S corps in Subchapter S and fundamental rules involving partnership taxation in Subchapter K.

For those curious about why we think the Supreme Court will ultimately decide to rule narrowly in favor of the government, see the Appendix with a detailed discussion of the oral arguments.

Navigating the Impact on U.S. Corporations

Which public companies might be impacted by the Supreme Court striking down the MRT? Let’s assume for this purpose we are only talking about the direct impacts from the decision (for example, if the Supreme Court were to strike down Section 965 as unconstitutional) and not the broader uncertainty/litigation it might create concerning non-TCJA provisions. While some might like to think that when the Supreme Court holds a statute to be unconstitutional, it is as if the law was never enacted in the first place (as it if were erased from the law retroactively)—that is not exactly what happens.

As a threshold matter, it’s likely that only those companies that either:

- still have their statute of limitations on assessment for the year in question open; or

- filed a protective claim for refund16

will be impacted (either positively or negatively) by such a decision.

“Once suit is barred by res judicata or by statutes of limitation or repose, a new rule cannot reopen the door already closed.”17

Our focus on either an open statute (1) or whether a protective refund claim was filed (2) assumes application of the Supreme Court’s retroactivity doctrine18—which is “overwhelmingly the norm.”19

That being said, there is a real question of whether retroactivity amongst all similarly situated taxpayers would be appropriate in this case.20 The remedies, if any, that the Court spells out in its decision will be critical to this analysis.

When the retroactivity doctrine applies, all cases still open can be impacted. That generally means, when it comes to tax cases, that Sections 6501 and 6511 are relevant.21 Under Section 6501, the IRS generally has three years from when the return is filed to assess a tax (this is the statute of limitations we refer to in (1) above), and under Section 6511, the taxpayer generally has (the later of) three years from when the return was due or two years from when the tax was paid (without regard to extensions or elections to pay in installments) to file a claim for refund.

To understand how this might play out, let’s take Apple Inc. (NASDAQ: AAPL) (Apple) as an example. According to public disclosures, it is believed that Apple had the highest MRT liability of all taxpayers—some $37.3 billion22—which it has been paying in installments. TCJA allowed taxpayers to choose to pay the MRT over eight years (years one through five, payment of 8 percent each year; year six, 15 percent; year seven, 20 percent; year eight, 25 percent). Most taxpayers electing to pay in installments won’t be done paying off the MRT until they file their 2024 tax return in 2025.23

However, Apple is not a calendar-year taxpayer. TCJA was enacted after Apple’s fiscal year ended September 30, 2017. This means that, unlike many calendar-year taxpayers,24 Apple recognized the deemed income associated with the MRT (and therefore technically had the tax hit, irrespective of its election to pay it in installments) on its 2018 tax return.25 According to its most recent annual report, Apple is still under IRS examination for its tax years after 2017—which implicitly means that Apple must have agreed to extend its statute of limitations for its 2018 tax return.

Because its statute of limitations is likely still open (and because the Moore decision is expected to be released in just a matter of months), Apple potentially could recover all of the MRT that it has paid were the Supreme Court to broadly hold26 that Section 965 is unconstitutional. As of September 30, 2023, the company still owned some $22 billion in MRT to the IRS, meaning it could potentially get some $15 billion back were the Supreme Court to rule in a way that would benefit taxpayers such as Apple.27 That’s nearly $1 per share, if the company decided to return such a windfall to its shareholders.28 (This analysis is limited exclusively to an MRT refund and not the impact to Apple from any other provisions that might be implicated.)

This is the best scenario for recovery—an open statute of limitations and the potential to recover the entire MRT paid.29 However, not every corporation that paid the MRT would be this lucky. If the statute of limitations has closed with respect to the relevant tax year (generally, 2017 for calendar-year taxpayers and 2018 for certain fiscal-year taxpayers30), then the potential for recovery is more limited if it is even available at all. Only those taxpayers that had the foresight to file valid protective claims for refund before their statute of limitations expired31 would likely have a solid chance of recovery. And that recovery would likely be limited.

A protective claim for refund may be filed in instances where the right to receive a refund is contingent on the occurrence of a future event (for example, the Supreme Court striking down Section 965 as unconstitutional) and the taxpayer wants to toll the statute of limitations (in cases where, if they were instead to wait for the contingency to occur before filing the claim for refund, they would no longer have a valid claim). A timely filed refund claim (protective or otherwise) is a prerequisite to filing a civil suit seeking a refund.32

The problem is that the Supreme Court held in Flora v. United States (362 U.S. 145 (1960)) that a taxpayer must have paid the tax in full before it can sue for a refund in district court or the Court of Federal Claims.33 This so-called Flora full payment rule means that, in practice, the IRS will deny an administrative claim for refund as invalid unless the tax is paid in full.34

Because of the Flora full payment rule, there’s a risk that corporations that had the foresight to file protective claims for refund before their statutes expired but are paying the MRT in installments may nevertheless be out of luck were the Supreme Court to broadly strike down Section 965. If you assume a corporation filed a protective refund claim on June 26, 2023 (the day the Supreme Court granted cert in Moore)—and you assume the relevant statute of limitations had not yet expired at the time the corporation filed its claim, which is a big assumption—and you further assume that the corporation won’t pay its final installment of the MRT until April 15, 2025, then there is a risk the claim was arguably invalid in 2023, because the tax wasn’t paid in full at the time.35 Unless the IRS allows the taxpayer to cure the original claim years later (in 2025, when it satisfies the Flora full payment rule but also when such amended claim would otherwise have been untimely),36 then such taxpayer might arguably have no basis upon which to file a refund suit in court to claw back the MRT.

In addition, the Tax Code puts a limit on the amount of the refund in certain cases. For example, if the claim was not filed within the three-year period after the filing of the return but was filed within two years of when the tax was paid, then the refund amount is limited to only the portion of the tax paid during the two years immediately preceding the filing of the claim.37

So, even for those taxpayers that had the foresight to both file a protective claim for refund before their statute closed and ensure that the MRT was paid in full at the time of the claim (or paid the balance due, if they had been paying in installments, for example), the amount recovered may be limited to only the portion of the MRT paid out (likely in this case) during the two years immediately preceding the claim filing,38 which may only be 68 percent.39

Some have argued that this cannot be the right answer and that the Due Process Clause should provide a remedy—even for those who didn’t file a protective refund claim and whose period of limitations has closed.40 Others have suggested that the courts might toll the statute of limitations for impacted taxpayers as an equitable remedy.41 The real impact and available remedies for taxpayers will depend in large part on the breadth of the decision—which is informed by the whims of the justices—and the vagaries of the IRS’s own rules.42

Gauging the Impact to Investors

While we wait for the decision to come down, there is something nervous investors can do to get a better sense of whether companies in which they hold large stakes might be impacted by Moore. The Institute on Taxation and Economic Policy (ITEP) reviewed public company disclosures to quantify the size of major U.S. multinationals’ MRT liability.43 According to ITEP, 389 multinational corporations might collectively be allocated some $271 billion in tax relief were Section 965 to be held unconstitutional. Note that this high-level analysis does not take into account the above procedural considerations. (Nervous investors can search securities filings to determine, for example, if the tax year at issue is still under audit, and therefore presume the statute of limitations has been extended.) The top 15 are as follows:

Note that ITEP only looked at the potential corporate beneficiaries were the Supreme Court to invalidate the MRT (and it assumed all corporations that paid the MRT would be eligible for a refund). It did not analyze the impact MRT invalidation would have on other aspects of the tax code (including TCJA-related provisions). There is an outstanding question (addressed in more detail below) concerning the extent to which provisions integrally tied to Section 965 (including, among others, Section 245A and certain Subpart F provisions that effectuate the MRT) might become unavailable were the Supreme Court to strike down Section 965 (which gets to the issue of severability). If the ruling is broad enough, certain of these corporations could end up being harmed. For more on this possibility, read on about Altaba.

Beyond integral TCJA-related provisions, there’s also the risk that—depending on how broad the ruling is—other look-through provisions of the Tax Code (including Subchapter K and Subchapter S) and other deemed realization provisions of the Tax Code (including the original issue discount rules and the mark-to-market rules) could be subject to challenge as unconstitutional, opening the door to litigation and uncertainty.

Impact on Altaba

Altaba greatly benefited from TCJA, because the legislation lowered the corporate tax rate to

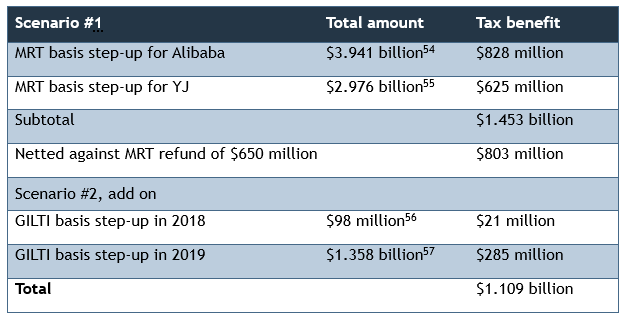

21 percent and imposed the MRT, which delivered to Altaba a combined basis step-up (for both its stakes in Alibaba and Yahoo Japan) of nearly $7 billion.44 TCJA also imposed a tax on GILTI, which further stepped up Altaba’s basis in these stakes. Combined, these basis step-ups reduced the taxes Altaba had to pay when it sold its stakes in those two foreign companies. While Altaba had to pay some $650 million in MRT after the application of foreign tax credits (FTCs),45 it arguably paid some $1.7 billion less (see important caveats in footnote) in taxes as a result of the MRT- and GILTI-related basis step-ups.46

So if the MRT is struck down as unconstitutional, will Altaba be impacted?

The answer depends on the scope of the opinion. Assuming it is broad enough that it impacts corporate shareholders such as Altaba (which is a big if), then Altaba could be looking at a worst-case scenario net detriment of some $1.2 billion. Altaba’s 2018 tax year47 (in which the MRT-related basis step-up and a small GILTI basis step-up hits) and its 2019 tax year48 (in which the bulk of the GILTI-related basis step-up hits) are both still open (at least to our knowledge49) and are currently in IRS Exam (Altaba extended the statute of limitations on assessment for both its 2018 and 2019 tax years through February 202450). Further, even though Altaba initially elected to pay the MRT in installments, we believe that it was required to pay the balance due around the time that it filed for dissolution and sold the bulk of its assets.51

Assuming a Moore decision striking down Section 965 as unconstitutional extends to corporate shareholders such as Altaba and assuming Altaba’s statute is either still open or it files a claim for refund within six months of the end of its extended statute of limitations,52 then—because it satisfies the Flora full payment rule—Altaba should be eligible for a refund of the full $650 million MRT that it paid.

But what about the basis step-up benefits associated with the MRT (and GILTI)?53 For context, although the MRT is in Section 965, it relies on Subpart F rules that existed before TCJA for its implementation. The pro rata share of accumulated post-1986 deferred earnings is effectively deemed to be income under Section 951(a). You can’t have the MRT without that income inclusion. Further, Section 961 provides a basis step-up when there’s a Section 951(a) inclusion. Although these provisions—Sections 951(a) and 961—weren’t in TCJA, they are critical to implementing the MRT. GILTI was in TCJA, but the analysis for the GILTI step-up is similar.

Below we attempt to model out two scenarios: #1 is of more limited scope were the Supreme Court to strike down the MRT in a way that would impact corporations such as Altaba (and #1 assumes that the basis step-up that effectuates the MRT would also be unwound as a consequence). Scenario #2 addresses a more dire result in which the court’s ruling is so broad that it also strikes down certain of the other international tax provisions that were put in place at the same time as the MRT, which (of import to Altaba) would include GILTI.

Another consequence of such a broad Moore decision would be that the FTCs that Altaba used to reduce its MRT and GILTI tax liability could go away (but the underlying liability would also go away). We did not include the FTC impact in the table above for two reasons. First, it is our understanding that Altaba’s MRT liability of $650 million was after accounting for applicable FTCs,58 so if the FTCs go away and the MRT goes away, $650 million should reflect the amount of refund Altaba could receive. Second, we believe that Altaba may have used FTCs to zero out the tax hit from GILTI. So, net-net, it should not be a major factor in the scenarios above.

On a somewhat positive note, it’s our understanding that if such a broad Moore decision were to come down, two of the three main areas of dispute that Altaba and the IRS are still fighting over with respect to Altaba’s 2018 and 2019 taxes59 would go away, because they relate to FTCs and GILTI. That means that the only major remaining item that Altaba would have to reserve for would be the blockage discount disallowance, which we believe to be the smallest of the three areas (maybe only about $100 million, which is how we get to a net $1.2 billion number).

It remains to be seen exactly how many dominoes will fall if the MRT is struck down. The Tax Code contains an arguably broad, express severability clause in Section 7852(a) that is applicable to any provision in Title 26 (that is, the entire Tax Code). It provides that “if any provision of this title, or the application thereof to any person or circumstances, is held invalid, the remainder of the title, and the application of such provision to other persons or circumstances, shall not be affected thereby.”

The Small Business and Entrepreneurship Council (SBEC) filed an amicus brief that makes the case that even if the Moores were to win and the MRT were found to be unconstitutional, then “only the requirement to pay the MRT should be invalid.”60 It takes the position that “holding the MRT invalid and inoperative would not render any other provisions incapable of functioning independently and fully,” presumably including Section 965(a).

SBEC goes on to argue that if the Court were to invalidate the MRT, taxpayers should still be able include their portion of the controlled foreign corporation’s earnings (the same earnings that triggered the tax giving rise to the MRT dispute) in their 2017 gross income for purposes other than calculating and paying the MRT (and presumably should also keep the basis step-up).

We do not think SBEC’s argument will win the day. We think there is almost no chance Altaba will get a refund of its MRT ($650 million) and still be able to keep the nearly $1.5 billion in related MRT basis step-up tax benefits.

On the other end of the spectrum, Loyola Law School Professor Ted Seto, who also authored an amicus brief in the Moore case, thinks there is the possibility that if Section 965 were held to be invalid, then “the whole of TCJA is invalid as well. It may reasonably be asked whether Congress would have enacted the TCJA at all if it had known that that act would lose an additional $338.8 billion over the $1,456 billion it was already projected to lose.”61 Seto argues that the Supreme Court could interpret the severability provision to require that “the entirety of Subtitle D, Part I of the TCJA, which effected the change in tax regimes governing the earnings of foreign subsidiaries, should be declared invalid as inseverable from 26 U.S.C. 965.”

So Why Is Altaba Hoarding Cash Reserves?

As it happens, Altaba—which is in the process of liquidating and distributing its remaining assets to shareholders62—has been sitting on some $375 million in excess reserves that have been authorized for distribution to shareholders (amounting to about 72 cents per share) but, with respect to which the company has nevertheless retained for several weeks now (and—with respect to some $200 million of that excess, for several months). Investors are wondering whether the apparent decision to retain the excess cash has something to do with the potential risk that Moore poses to Altaba (which, to be clear, we think is extremely low63).

As a reminder, Altaba has to satisfy all of its outstanding liabilities (and resolve those that remain in dispute) before it can dissolve. For the last couple of years, there have been just three remaining “buckets” of disputed items: (1) the Larocque matter (associated with a Canadian class action related to data breach claims against Altaba’s predecessor Yahoo! Inc.); (2) the Droplets matter (associated with a federal intellectual property patent infringement lawsuit); and (3) the IRS tax matter. The latter involves some $700 million to $800 million in disputed federal tax items, with such amount set aside in a separate custody account to fully cover those liabilities were the IRS to prevail on the tax and penalties due. Altaba may elect to increase (or decrease) the amount set aside in the account “based on further developments.”64

The $375 million or so of excess is related to buckets (1) and (2)—which have since both essentially been resolved. But what if Altaba has decided that the potential (albeit, extremely low) $1.1 billion65 tax risk presented by Moore justified it retaining that extra $375 million until the potential tax uncertainty is resolved? Is that why there hasn’t been a recent distribution?

The company isn’t talking—so it’s hard to know if this speculation is justified or not. However, there are a few variables to consider when delving into the possibility that Altaba might be hoarding cash to account for the potential Moore risk.

- Open Statute of Limitations—As already discussed, if Altaba’s statute is still open when the decision is issued—and the decision is broad enough—then Altaba could potentially be at risk of losing its MRT- and GILTI-related basis step-ups.

- Closed Statute of Limitations—If Altaba decides not to extend the statute for tax years 2018 and 2019 (currently set to expire this month) and decides to surrender its fight with the IRS, then—assuming it can time it right66—the Moore decision (regardless of its breadth, severability and retroactivity) may not negatively impact the company, but Altaba would have to pay whatever the IRS thinks it owes for 2018 and 2019 and would not be able to dispute the amount in Tax Court, for example.

- Director Liability—Because the tax dispute is no longer part of the State of Delaware Court of Chancery-supervised wind-up proceedings pursuant to Sections 280 and 281(a) of the Delaware General Corporation Law (DGCL), Altaba’s Board might be concerned that it has less protection were it found to have authorized a distribution to shareholders that was later determined to be in excess (that is, if Altaba hadn’t retained sufficient assets to ultimately satisfy its tax liabilities).67 Such a distribution would fall outside of the safe harbor procedures under Sections 280 and 281(a).

With the limited information we have, we would be extremely surprised if Altaba attempted to close its statute of limitations on assessment before the Moore decision comes down. It may very well decide not to extend the statute if the company feels like it’s not making any progress with the Exam team for the 2018 and 2019 years. But we expect Altaba will want to continue to fight to reduce its tax liability by, among other things, going to Tax Court, where it should still be able to enter into a settlement with the IRS.68 However, the statute of limitations tolls under Section 6503(a)(1) when you go to Tax Court, so Altaba wouldn’t be shielded from the potential effects of Moore. In any case, the decision to extend—or not—the statute of limitations on assessment for 2018 and 2019 should really turn on Altaba’s underlying dispute with the IRS and not on the extremely speculative risk potentially presented by Moore.

When Altaba’s Board adopted the Plan of Complete Liquidation and Dissolution back in April of 2019, it probably thought that would facilitate expedient resolution of any outstanding liabilities—including uncertainties associated with its federal taxes. But as we approach the five-year mark, investors are getting impatient—and maybe the Board is, too. Declining to extend the statute of limitations on assessment may be just what this seemingly never-ending dispute needs to shake things up and get to a resolution. Not that the Tax Court is ever viewed as an expedient way to achieve a result, but—given the circumstances (and given that Altaba doesn’t seem to be making any headway with its Exam team)—such a strategy might make sense.

What doesn’t make a lot of sense is for Altaba to hoard its excess cash on account of miniscule Moore-related tax risks. Such hoarding, however, might make sense if new information has come to light as part of the Exam such that Altaba now has a more pessimistic view of its tax liability in general—unrelated to questions regarding the constitutionality of Section 965.

If such new information is substantial enough that it raises potential excess distribution concerns and a fear on the part of Altaba’s Board that it could be jointly and severally liable for the full amount of unlawful distributions, then Altaba should be transparent about that. A prerequisite to finding that there have been unlawful distributions is a showing that such distributions were made willfully or negligently in violation of DGCL.69 As we’ve previously written,70 directors are protected from liability if they make distributions in reliance in good faith upon statements or opinions from advisors with professional or expert competence on the matter regarding the amount of the corporation’s surplus (which depends upon an estimate of the corporation’s liabilities).71 If Altaba’s Board has new information indicating that its outstanding tax liability could now be in excess of $1 billion (to justify the hoarding), then it should disclose that.

Back to Moore—Expectations and Predictions

We may be biased, but what could be more high-profile and socially divisive than U.S. tax policy? The decision in the Moore case will have a profound impact on the future even if the Court finds a way to thread the needle and resolve the MRT’s constitutionality in a way that doesn’t have billions of dollars of collateral effects on the economy.

While there is a lot at stake, the tenor of the justices’ questions during the oral arguments makes us suspect that a narrow ruling in favor of the government could be in the cards (for more on the oral arguments, see the Appendix). We say that fully recognizing that the Supreme Court is comprised of a solid 6-3 conservative majority and even though the Court’s mere acceptance of the case suggested that at least four of the justices presumably might be inclined to require realization in the context of an income tax under the Sixteenth Amendment. We anxiously await the decision.

One or more authors may have positions in stocks referred to in this article. Akin may represent individuals or entities that may have positions in stocks referred to in this article.

Akin Gump Strauss Hauer & Feld LLP has a full tax team closely following developments in this area. Please feel free to contact any of them with any questions.

APPENDIX: A Deeper Dive into the Oral Arguments

The biggest takeaway from the oral arguments was that the Court seemed cognizant of the impact its opinion could have, indicating it would prefer to tread cautiously, narrowly tailoring its ruling to ensure that it does not have “far-reaching consequences” (in the words of Justice Alito). The justices seemed prepared with probing questions, and the oral arguments (which are usually only slotted for an hour) lasted for over two hours.

Early on in the arguments, counsel for the Moores (Andrew M. Grossman of Baker & Hostetler LLP) acknowledged that the petitioners believe that Subpart F is constitutional. But he insisted that the MRT can be distinguished from Subpart F. Unfortunately for him, the justices seemed set on characterizing the MRT’s primary distinguishing factor (that it “doesn't take account of any power that the shareholder had over the income as it was coming in the door to the corporation,” in Grossman’s words) as a timing issue that doesn’t go to the realization question but could simply provide the basis for a due process challenge.

Grossman’s other argument as to why Subpart F and the MRT are different was that Subpart F is focused on a particular category of income susceptible to abuse whereas the MRT involves ordinary business income generated through normal (albeit foreign) operations. The government responded that—by its terms—the Sixteenth Amendment says that Congress can tax all income from whatever source derived, so the type of income shouldn’t matter.

Solicitor General Elizabeth Prelogar framed the MRT as simply a pass-through tax on actually realized corporate income and stressed that—just like with Subpart F—the petitioners in this case are simply 10-percent U.S. shareholders with “the requisite level of relationship in order to properly have income attributed to them.”

Some were shocked by the concession made by General Prelogar that, in the government’s view, Congress has the authority today to impose an income tax on the appreciation in value of retirement accounts and real property even if the underlying mutual fund shares or real estate holdings weren’t actually sold. “That door is already open. Congress can enact that tax,” she said.

General Prelogar went on to note that—were such a tax to be enacted—even though the government “would likely defend such a tax on appreciation between two points in time as an income tax,” the Supreme Court could more carefully scrutinize it, given that it might be viewed as crossing a line or limiting principle that, from a historical perspective, is improper (although she acknowledged that such a view might not be dispositive).

“There are huge practical and policy reasons why these taxes wouldn't be enacted,” General Prelogar said, stressing that the justices “don't have to agree that that tax would be valid in order to uphold the MRT.”

Some of the justices seemed sensitive to the fact that this acknowledgement by the Solicitor General might make some on the bench—for example Chief Justice Roberts and Justice Alito—uncomfortable. Justice Kavanaugh noted that, even though the government thinks Congress has the power to tax appreciation now, “members of Congress want to get reelected.” “We’ll probably never see those kinds of taxes in our lifetimes,” added Justice Kagan.

Indeed, there are no indications that any of the current wealth tax proposals—including the Billionaires Income Tax Act introduced by Senate Finance Committee Chairman Ron Wyden (D-OR) November 30, 202372 and the Billionaire Minimum Tax proposed by President Biden March 9, 202373—have anywhere near a critical mass of support even among Democrats.

Indications of a Narrow Ruling

Based on their questioning, it seemed as if the justices were seeking to find a middle ground—one that would neither (in the words of the General Prelogar) “cause a sea change in the operation of the Tax Code and cost several trillions of dollars in lost tax revenue” nor (in the words of Grossman) “open the door to taxation of practically everything.”

Many of them—Justice Gorsuch in particular—seemed to indicate that they would prefer to rule in a way that takes into account the lens of the Sixteenth Amendment,74 arguably preserving some concept of realization (without explicitly stating that realization is required or defining what realization means) but maybe reframing the focus somewhat. After fairly extensive back-and-forth between Justice Gorsuch and General Prelogar, it was suggested that the analysis focus instead on whether there’s been a fair attribution of the corporate income (which was actually realized at the corporate level in this case) to the shareholder.

General Prelogar said one factor that should be considered is the taxpayer’s overall relationship to the income and the entity (taking into account level of influence, for example, but not requiring a finding of control or enjoyment per se). There might also be some benefit associated with earning the income in the entity that would influence the attribution determination.

In their briefs, the petitioners embraced the concept of “constructive realization” as—in Grossman’s words—referring to the general principle “that income should be taxed to he who earns it and enjoys its benefits.” They encourage the Court to reaffirm the definition of realization that they argue it has historically espoused in its Sixteenth Amendment decisions (which presumably is consistent with this new “constructive realization” concept) and contend that doing so would not threaten other sections of the Tax Code.

At one point, Justice Gorsuch seemed to indicate that he thought the petitioner’s concept of “constructive realization” sounded a lot like the government’s concept of fair attribution. But General Prelogar disagreed. She said the Court should not call the construct it embraces “constructive realization,” as it’s “inherently amorphous” and would “open up immediate disputes about what exactly it encompasses.”

General Prelogar cautioned the justices on various other points, and in some cases, her warnings seemed to be met by appreciative acceptances on the part of Justice Gorsuch in particular (who said “roger that” multiple times in response). She stressed that the Court:

- Should not explicitly answer the question of whether the Sixteenth Amendment requires realization, as doing so would “wreak havoc on the proper operation of the Tax Code”;

- Should not establish an explicit set of principles to govern all cases, as that will invite gaming by taxpayers (for example, she cautioned them against coming up with a global definition of income).

Justice Sotomayor seemed particularly attuned to the potential traps presented by the question posed by the petitioners. “You're asking us to just announce what realization is out of context. And for the last hundred years, we've been studiously avoiding doing that because we recognize that it's dangerous to do that,” she said to Grossman. “Here, it doesn't need realization, because Congress has attributed this to the individual owners of the corporation.”

Chief Justice Roberts, on the other hand, seemed skeptical of the government’s argument. “You've buried Macomber,” he said. “What's left to defend the proposition that the government can’t tax as income the appreciation in value of property once you've stabbed Macomber?”

General Prelogar said she is not to blame. “We're invoking this Court's own precedent about Macomber's scope and reach. It's the Court itself that said that Macomber is limited to the particular type of stock dividend” not at issue in this case, she said. “I am not asking the Court to overrule any precedent in this case. I'm asking the Court to follow its precedent that postdates Macomber. . . . I recognize that there is language in Macomber that seemed to have broader sweep, but this Court itself has already recognized that that is not the right way to read the language.”

Grossman, for his part, stressed in his rebuttal that “the government's recalibrated position . . . is not narrow and the Court should not mistake it as such. The government's view that a corporation's earnings can simply be attributed to . . . any corporate shareholder is staggeringly broad.” He went on to suggest that if corporate earnings can simply be treated as Sixteenth Amendment income to any shareholder with a close enough relationship to the corporation, then the government would already have the authority to attribute hundreds of billions of dollars of retained earnings of corporations like Microsoft and ExxonMobil going back many years to certain current shareholders—even in excess of the current value of the shares.

Justice Gorsuch said he thought there “is room for some narrow ground.” Taking all of the justices’ comments at the oral argument into consideration (for what that’s worth), it seems that there might be enough votes (five is all that would be required—and we suspect that at least Justice Roberts and Justice Thomas will likely not be in that group) to rule in favor of the government.

1 No. 22-800. Note that although the Moore case involves individual shareholders, another case addresses this issue with respect to corporate shareholders (Altria Group Inc. v. United States, No. 3:23-cv-00293 in the U.S. District Court for the Eastern District of Virginia, which is stayed pending resolution of Moore). In 2017, Altria owned 10.2% of Anheuser-Busch InBev SA/NV, which is not a CFC but a so-called 10/50 company—where U.S. ownership is between 10% and 50%. That is, Altria was a 10% (or greater) U.S. shareholder of a foreign corporation, but the foreign corporation fell outside the scope of Subpart F because its U.S. shareholders did not—in the aggregate—own more than 50% of the vote or value of the foreign corporation’s stock. There may be an outstanding question of whether the Sixteenth Amendment even applies to corporations, as some are of the view that the Supreme Court has ruled that the corporate tax is an excise tax and not an income tax. For example, see “Effects From Moore: Does the Corporate Tax Require Realization?” authored by Reuven S. Avi-Yonah and published by Tax Notes Jan. 22, 2024 (subscription required). One argument for why IRC §965 is unconstitutional both with respect to individuals such as the Moores and corporations such as Altria is that such shareholders did not actually have control over the foreign corporations in question.

2 Depending on who is assigned to author the opinion, the level of agreement at the Justices' Conference and whether any justices decide to write concurring or dissenting opinions, the decision could be issued more quickly (we are assuming this one will be tricky). That being said, the Supreme Court is handling a number of tricky cases this term, including (among others) whether Donald Trump is disqualified from holding the office of President (Docket No. 23-719); whether the Court should overrule or narrow the application of the Chevron Doctrine, which generally provides that courts should defer to an agency’s reasonable interpretation of an ambiguous statute (Dockets No. 22-451, 22-1219); and whether the Food and Drug Administration violated the Administrative Procedure Act when it modified conditions for use of the abortion pill mifepristone (Dockets No. 23-235, 23-236).

3 https://www.supremecourt.gov/qp/22-00800qp.pdf

4 Daniel Bunn, Alan Cole, William McBride, Garrett Watson, Tax Foundation, How the Moore Supreme Court Case Could Reshape Taxation of Unrealized Income (Aug. 30, 2023) (https://taxfoundation.org/research/all/federal/moore-v-united-states-tax-unrealized-income/); For perspective, on Dec. 18, 2017, the Joint Committee on Taxation (JCT) estimated that TCJA’s enactment of just IRC §965 would result in an additional $338.8 billion over the 10-year period from 2018 through 2027. (For JCX-67-17, see https://www.jct.gov/publications/2017/jcx-67-17/).

5 The Sixteenth Amendment to the Constitution provides that “Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.” Moore is ultimately about whether undistributed corporate earnings can be considered income for this purpose.

6 252 U.S. 189 (1920).

7 Melissa Costa and Caitlin McGovern, IRS Statistics of Income Special Release, Effect of IRC Section 965 Transition Tax on Domestic Corporations, Tax Year 2017 (https://www.irs.gov/pub/irs-soi/soi-a-co965-id2002.pdf.pdf).

8 See JCX-67-17, line item for “Treatment of deferred foreign income upon transition to participation exemption system of taxation and mandatory inclusion at two-tier rate” (https://www.jct.gov/publications/2017/jcx-67-17/).

9 See JCX-67-17, line item for “Deduction for dividends received by domestic corporations from certain foreign corporations” (https://www.jct.gov/publications/2017/jcx-67-17/). Note that some argue that if the MRT is held unconstitutional, other provisions of TCJA, including §245A, may remain in full effect. See, e.g, the Brief of Amicus Curiae Small Business and Entrepreneurship Council in Support of Neither Party (https://www.supremecourt.gov/DocketPDF/22/22-800/278913/20230906121518993_Small%20Business%20Entrepreneurship%20Council%20Moore%20Amicus%20Brief.pdf).

10 Altaba Form N-CSR filed Feb. 27, 2019 (https://www.sec.gov/Archives/edgar/data/1011006/000119312519052960/d689719dncsr.htm). It is our understanding that Altaba originally owed some $1.072 billion in MRT, but only paid about $650 million after taking into account applicable FTCs.

11 Id. Note that the Altaba Form N-CSR filed Feb. 26, 2018 also lists “one time toll tax investment basis step-up” as $1,512,188,000 (https://www.sec.gov/Archives/edgar/data/1011006/000119312518058471/d434197dncsr.htm).

12 For more on this estimate, see discussion starting on page 10.

13 As a sidenote, the Moores might not be the most sympathetic petitioners in the big scheme of things. Although they had to pay $15,000 in MRT, the MRT basis step-up they received meant that they actually ended up saving more than twice that much in taxes when they ultimately sold some of their stake in the company, which, according to press reports, they did in 2019 (Andrew Velarde, Moore Sold Shares in Transition Tax Company for Big Gain, Tax Notes, Dec. 4, 2023 (subscription required)).

14 As noted in the Appendix, there are no indications that any of the current wealth tax proposals—including the Billionaires Income Tax Act introduced by Senate Finance Committee Chairman Ron Wyden (D-OR) and the Billionaire Minimum Tax proposed by President Biden—have anywhere near a critical mass of support even among Democrats.

15 David Kamin, Thalia Spinrad and Chye-Ching Huang, New Supreme Court Case Could Unsettle Large, Longstanding, Parts of the Tax Code Built on a Bipartisan Basis Over Decades and Give a Windfall to Multinational Corporations, Tax Law Center at New York University School of Law, June 26, 2023 (https://medium.com/@taxlawcenter/new-supreme-court-case-could-unsettle-large-longstanding-parts-of-the-tax-code-built-on-a-af0982f2cf85).

16 Note that, because many in the tax world were surprised when the Supreme Court agreed to grant cert in Moore, most taxpayers likely wouldn’t have had the foresight to have filed protective claims for refund prior to the grant of cert, which occurred on June 26, 2023, at which point (absent extension) the statute of limitations on assessment for tax year 2017 would have long-since expired. That being said, many large corporations are under continuous audit and are in the habit of extending the statute of limitations to facilitate Examination and Appeal. All claims for refund must satisfy Treas. Reg. §301.6402-2.

17 James B. Beam Distilling Co. v. Georgia (501 U.S. 529 (1991)).

18 See Harper v. Virginia Dep’t of Taxation (509 U.S. 86 (1993)), which held that “when this Court applies a rule of federal law to the parties before it, that rule is the controlling interpretation of federal law and must be given full retroactive effect in all cases still open on direct review and as to all events, regardless of whether such events predate or postdate our announcement of the rule” (https://tile.loc.gov/storage-services/service/ll/usrep/usrep509/usrep509086/usrep509086.pdf). Note that, in this case, the Court indicated that the appropriate remedy should be retroactive regardless of whether it was a refund or the assessment of additional tax due. However, not all of the justices agreed. Justice O’Connor argued that Chevron Oil was incorrectly applied in Harper, and that the underlying decision should have been applied with nonretroactive effect.

19 James B. Beam Distilling Co. v. Georgia (501 U.S. 529 (1991)) ruled that “when the Court has applied a rule of law to the litigants in one case it must do so with respect to all others not barred by procedural requirements or res judicata.” In the James B. Beam decision, the Court explained that although the doctrine of retroactivity is the norm (and is assumed if the Court is silent on the matter), the Court also has discretion to apply its decisions either purely or selectively prospectively. (https://tile.loc.gov/storage-services/service/ll/usrep/usrep404/usrep404097/usrep404097.pdf)

20 See Chevron Oil Co. v. Huson (404 U.S. 97 (1971)), in which the Court decided to invoke the doctrine of nonretroactive application after a weighing of the equities. In Chevron Oil, the Court stated that prospective decisions are generally appropriate when, among other factors, the decision establishes “a new principle of law, either by overruling clear past precent on which litigants may have relied . . . or by deciding an issue of first impression whose resolution was not clearly foreshadowed.” Further, prospective decisions would also be appropriate “’where a decision of this Court could produce substantial inequitable results if applied retroactively.” (https://tile.loc.gov/storage-services/service/ll/usrep/usrep404/usrep404097/usrep404097.pdf)

21 In United States v. Clintwood Elkhorn Mining Co., 553 U.S. 1 (2008), the Court held that “the plain language of 26 U.S.C. §§7422(a) and 6511 requires a taxpayer seeking a refund for a tax assessed in violation of the Export Clause, just as for any other unlawfully assessed tax, to file a timely administrative refund claim before bringing suit against the Government.”

22 Apple Form 10-K Annual Report, filed Nov. 5, 2018, page 52 (https://www.sec.gov/Archives/edgar/data/320193/000032019318000145/a10-k20189292018.htm).

23 Pursuant to §965(h)(2), each succeeding installment shall be paid on the due date (determined without regard to any extension of time for filing the return) for the tax return. Corporate income tax returns are generally due on the 15th day of the fourth month following the close of the tax year.

24 This is an oversimplification, because the MRT applies to the last taxable year of specified foreign corporations beginning before Jan. 1, 2018, and the tax is includible in the U.S. shareholder’s tax year in which or with which the specified foreign corporation’s year ends. See also Note 45 for an example of how this might play out.

25 Id.

26 Among many options, the Court could hold §965 unconstitutional only with respect to individual shareholders—or even just with respect to certain individual shareholders (for example, those that acquired their stakes in a foreign corporation right before TCJA imposed the tax). Supra, Note 1.

27 Apple Form 10-K Annual Report, filed Nov. 3, 2023 (https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/320193/000032019323000106/aapl-20230930.htm).

28 As of Oct. 20, 2023, Apple had 15,552,752,000 shares of common stock outstanding.

29 In instances where a taxpayer agreed to extend the statute of limitations for assessment, then such taxpayer has more time to file the claim for refund. That is, pursuant to IRC §6511(c)(1), its refund claim is timely as long as the claim is filed within six months following when the extended statute expires. If the claim was filed after the statute was extended (but within six months following its extended expiration), then the amount of the refund is capped at the portion of the tax paid during the three years from the time the return was filed and is increased for any portion of the tax paid after the extension and before the claim was filed.

30 But see Note 24.

31 But see Note 16.

32 See §7422(a) and Treas. Reg. § 301.6402-2. You can’t bring suit (file a refund action in court) until you have either waited six months from filing the claim or until you have heard back from the IRS (that is, the IRS took final action on the claim, for example, by denying it). Note that technically, the IRS doesn’t have to respond to a refund claim (for example, on an amended return), and it often doesn’t. At that point, the only recourse is to go to court and file a refund suit.

33 Note that the Tax Court is the only prepayment forum. However, access to the Tax Court is limited to those taxpayers that have received a notice of deficiency from the IRS. That is, a U.S. multinational would have to have refused to pay the MRT under the auspices that it was unconstitutional—an arguably unlikely scenario at the time—and then been examined by the IRS and been issued a notice of deficiency with respect to the MRT underpayment in order for this avenue to be available.

34 See also the briefs in Kyocera AVX Components Corp. v. United States, No. 22-cv-02440 in the U.S. District Court for the District of South Carolina, in which the government argues that a taxpayer’s election to pay the MRT in installments does not exempt it from the Flora full payment rule.

35 There is an argument that the claim was not one for refund (since the tax hadn’t been paid in full) but rather for abatement. However, IRC §6404, which provides that the IRS may (but does not have to) abate the unpaid portion of a tax that, among other things, “is erroneously or illegally assessed,” is unavailable for taxes imposed under subtitle A, of which the MRT is one.

36 In PMTA 2023-001, the IRS contemplated a scenario in which an incomplete claim is filed during the claim-filing period that might not be treated by the IRS as a complete claim at the time but that—under certain circumstances that are at the discretion of the Service—might later be treated as such. The PMTA reiterates that “a claim that is untimely-filed pursuant to section 6511(a) would not be ‘duly filed’ pursuant to section 7422.”

37 IRC §6511(b)(2).

38 Id.

39 This assumes a calendar-year taxpayer filed a protective claim for refund in the summer of 2023, at which point it has already paid 55% of its MRT and had 45% remaining. If it paid the balance due at the time it filed the protective claim for refund, then the amount it paid within two years of same was 45% + 15% + 8% = 68%.

40 George Clarke, Sonya Bishop, Joseph Judkins, Ethan Kroll, Vivek Patel and Varuni Balasubramaniam, Moore Is Not Enough – How to Recover an Unconstitutional Tax, Daily Tax Report, July 31, 2023 (subscription required). In the article, the authors cite McKesson Corp. v. Florida Division of Alcoholic Beverages and Tobacco, 496 U.S. 18 (1990), for the that proposition the Due Process Clause should provide a remedy for unconstitutional taxes.

41 Edward L. Froelich and Caroline H. Ngo, Filing a Protective Refund Claim (with a Moore Angle), McDermott Will & Emery, Sept. 25, 2023 (https://www.mwe.com/insights/filing-a-protective-refund-claim-with-a-moore-angle/).

42 For example, see Treas. Reg. §301.6402-2(b)(2), which provides that “the IRS does not have the authority to refund on equitable grounds penalties or other amounts legally collected.”

43 ITEP, Supreme Corporate Tax Giveaway: Who Would Benefit from the Roberts Court Striking Down the Mandatory Repatriation Tax? (Sept. 27, 2023) (https://itep.org/supreme-court-moore-v-us-mandatory-repatriation-tax-corporate-tax-avoidance/).

44 Based on Altaba’s 2018 Form 965, Schedule A (page ID# 146) disclosed in connection with U.S. v. Altaba Inc., D. Del. (Case No. 1:20-cv-00811-UNA).

45 Supra, Note 10. See Altaba’s 2018 Form 965 (page ID#148) disclosed in connection with U.S. v. Altaba Inc., D. Del. (Case No. 1:20-cv-00811-UNA), which indicates that Altaba’s total MRT liability was $1.072 billion ($6.917 billion - $1.812 billion = $5.105 billion x 21% = $1.072 billion).

46 Note that our estimates are designed to assist investors that are focused on a worst-case scenario. These worst-case basis step-up assumptions are based on numbers that were reported on Altaba’s 2018 and 2019 returns, as disclosed in exhibits associated with the collection action that the IRS filed against Altaba in U.S. District Court on June 16, 2020. That being said, we have extremely limited visibility into the details of Altaba’s tax position and therefore there is a chance that none of the numbers disclosed are accurate. As previously mentioned, in Feb. 2019 Altaba itself disclosed a net income tax benefit of $1.5 billion due solely to the MRT basis step-up. Supra, Notes 10 and 11.

47 Altaba is a calendar-year taxpayer. However, because Alibaba and Yahoo Japan are both fiscal-year taxpayers (their fiscal year ends March 31) and because of the effective dates of, among other things, the downward attribution change in TCJA, Altaba’s IRC §965 income inclusion with respect to its pro rata share of Alibaba’s and Yahoo Japan’s deferred foreign income likely didn’t occur until March 31, 2018 (the end of the foreign corporation’s last taxable year that begins before January 1, 2018), which effectively means that the MRT-related basis step-up also didn’t happen until then. Altaba appears to have claimed GILTI basis step ups on both its 2018 and 2019 tax returns.

48 Id.

49 The last time Altaba updated investors regarding the status of its IRS dispute was in August 2023.

50 Altaba, Form N-CSRS, filed Aug. 11, 2023 (https://www.sec.gov/Archives/edgar/data/1011006/000119312523210687/d507160dncsrs.htm).

51 Pursuant to IRC §965(h)(3), upon an acceleration event such as “a liquidation or sale of substantially all the assets of the taxpayer (including in a title 11 or similar case), a cessation of business by the taxpayer, or any similar circumstance, then the unpaid portion of all remaining installments shall be due on the date of such event.”

52 Supra, Note 29.

53 The MRT basis step-up rule is in §961(a). It generally says that the basis of a U.S. shareholder's (either the Moores or Altaba) stock in a CFC (either KisanKraft or Alibaba/Yahoo Japan) shall be increased by the amount required to be included in his gross income under §951(a) with respect to such stock (which would include the MRT income inclusion that is treated as Subpart F income and included pursuant to §951(a)). But §961(a) goes on to say "only to the extent to which such amount was included in the gross income." So if §965 goes away because it is struck down as unconstitutional, then—notwithstanding that some might disagree—there is a real risk that there is no associated Subpart F income inclusion under §951(a) and therefore no basis step-up. The GILTI-related basis step-up analysis is similar.

54 See Altaba’s 2018 Form 965, Schedule A (page ID# 146).

55 Id.

56 Altaba’s 2018 Form 1120, Schedule C (page ID# 145)

57 Page 32 of Exhibit E (page ID# 118).

58 Supra, Note 45.

59 For more on this, see our prior report “Altaba’s End-of-Year Surprise to Investors: Setting Aside an Additional $235+ Million for Increased Tax Risks” (Dec. 30, 2021).

60 https://www.supremecourt.gov/DocketPDF/22/22-800/278913/20230906121518993_Small%20Business%20Entrepreneurship%20Council%20Moore%20Amicus%20Brief.pdf

61 https://www.supremecourt.gov/DocketPDF/22/22-800/284726/20231011152527608_Moore%20v%20US%20Amicus%20Brief%20of%20Theodore%20Seto.pdf

62 It’s our understanding that many Altaba investors are under the impression they stand to get about $2.75 in cash between now and its eventual final dissolution (which is the NAV as reported by Altaba as of Sept. 30, 2023). The last time Altaba made a distribution to shareholders was on February 17, 2023.

63 In our view, the most likely impact of Moore on Altaba will be nothing, because we suspect the justices will find a way to narrowly rule in favor of the government, in which case the MRT will be upheld. If it turns out that the Supreme Court invalidates the MRT, then the next most likely outcome would be that it would only narrowly do so in the limited case of certain individual shareholders, such that corporate shareholders like Altaba will not be impacted. If it turns out that the justices decide to invalidate the MRT with respect to all shareholders, then Altaba could be impacted. There is only an extremely small chance that the Supreme Court might decide to rule broadly enough in favor of the petitioners such that Altaba could potentially lose the benefits of its TCJA-related basis step-ups and might owe an additional $1.1 billion in taxes.

64 Altaba’s Form N-CSRS, filed Aug. 11, 2023 (https://www.sec.gov/Archives/edgar/data/1011006/000119312523210687/d507160dncsrs.htm).

65 $1.759 billion of potential lost TCJA basis step-up benefits – $650 million of potential MRT refund = about $1.1 billion

66 Altaba would need to receive a Statutory Notice of Deficiency (a so-called 90-day letter) this month, wait the 90 days without filing suit (during which time the statute is recomputed to account for the 90-day tack-on time), have its deficiency assessed, closing its 18/19 years in May and the Moore decision would have to not come out until June for this strategy to work.

67 In general, Delaware law limits the amount of a board‐declared dividend to the extent of the corporation’s surplus, which, for this purpose, is generally defined as “the excess, if any, at any given time, of the net assets of the corporation over the amount so determined to be capital” where net assets is defined as “the amount by which total assets exceed total liabilities”(DGCL § 170(a)). In addition, “no reduction of capital shall be made or effected unless the assets of the corporation remaining after such reduction shall be sufficient to pay any debts of the corporation for which payment has not been otherwise provided” (DGCL § 244(b)).

68 Subject to Rev. Proc. 2016-22, which states, among other things, that “in limited circumstances, a docketed case or issue that has not been designated for litigation will not be referred to Appeals if Division Counsel or a higher level Counsel official determines that referral is not in the interest of sound tax administration.”

69 DGCL §174.

70 “Altaba Liquidation Update: Navigating NASDAQ Delisting and Distributing Cash, Not Alibaba Shares” (March 19, 2019).

71 DGCL §172.

72 Press Release, Wyden, Wyden Leads Democratic Colleagues in Introducing Billionaires Income Tax (Nov. 30, 2023) (https://www.finance.senate.gov/chairmans-news/wyden-leads-democratic-colleagues-in-introducing-billionaires-income-tax).

73 Press Release, Treasury, U.S. Department of the Treasury Releases Greenbook, Outlining Tax Proposals to Reduce the Deficit, Expand Support for Working Families, and Ensure the Wealthy and Large Corporations Pay their Fair Share (March 9, 2023) (https://home.treasury.gov/news/featured-stories/us-department-of-the-treasury-releases-greenbook-outlining-tax-proposals-to-reduce-the-deficit-expand-support-for-working-families-and-ensure-the-wealthy-and-large-corporations-pay-their-fair-share).

74 General Prelogar noted that the government doesn’t “actually think that the case presents the question presented because here there was actual realization by the corporation.”